How to: settling Internal Orders and WBS elements costs to different Assets under Construction

Many companies using SAP need to run Assets accounting. When an asset is being physically created, the company needs to account for costs. These costs often form a part of a balance sheet that is called “Assets under construction”. SAP gives you an option to to accumulate costs of Assets under Construction (AuC) on the […]

Read MoreSpecial cases of tax posting

We have discussed recently the details related to types of tax codes and tax category assignment of the GL account. In that article SAP Expert mentioned that usually you do not post amounts directly to tax accounts. But sometimes you still do. Let’s discuss these cases in details.

Read MoreWhat is Tax Category on General Ledger account?

The General Ledger (GL) account is a very important element of master data in SAP. It has many configuration parameters that control system behaviour when a particular GL account is in use, either during document entry or reporting. One of these configuration elements is the Tax category. Let’s discuss this element in detail. Tax category […]

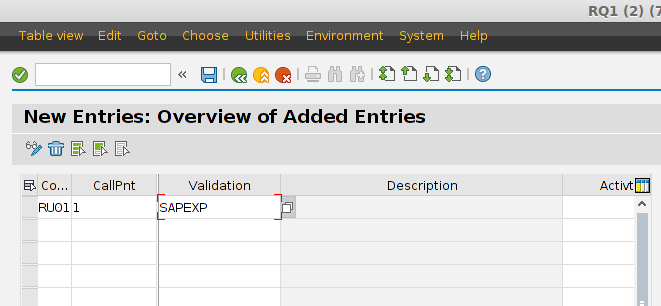

Read MoreHow to Move Substitutions and Validation Through the SAP System Landscape

SAP Expert continues a series of articles that cover methods of aligning objects across the SAP multisystem landscape. We have already discussed standard procedure for transport requests, and “special treatment” required for objects like tax codes and number ranges. Today we will talk about Substitutions and Validations.

Read More10 simple steps to move Tax Codes between SAP clients and systems

SAP Expert recently wrote about the mechanism that allows moving configuration objects between clients in the SAP system and between the systems themselves. This mechanism, the Transport System, is used for almost all the objects in SAP. However, there are some exceptions that require “special treatment”. They include Substitutions and Validations, Number ranges, and so […]

Read More

Dmitry Kaglik

December 7, 2015

SAP

2 Comments