Quick introduction to SAP Bank Communication Manager

SAP Bank Communication Manager (BCM) is one of the components of SAP Financial Supply Chain Management (FSCM) module. The responsibility of BCM, as it follows from its name, is in the management of relationships with the bank.

Let’s have a look at the processes that BCM supports. We will not look into details of the configuration, because these will be too much for this overview.

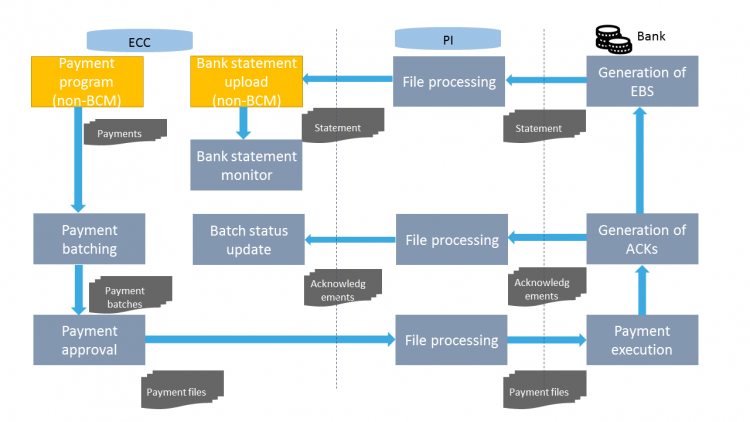

This diagram shows you an overview of processes you can manage through Bank Communication Manager on ECC and PI sides. There are three major parts, and we’ll look at each of them individually.

Payment authorization

The classical ERP payment process starts with the Automatic Payment Program (transaction F110). There is no difference for the Bank Communication Manager process. You run Payment Proposal, review it and then finalize your Payment Run. At this moment of time, your payment documents are generated and posted in the ledgers. Normally, you also generate your payment files for the bank and remittances for the vendors.

Here start the differences for the BCM process. You do not generate payment files directly from the payment program. Instead, you initiate the BCM process of payment batching.

Transaction FBPM1 is to create approval batches. Batch may contain payments from several payment runs, and one payment run may be split across several batches. There are various criteria that allows you to Approval batch generates a workflow item, which may also generate an email.

From this moment of time, SAP BCM does not work with individual payments, but only with payment batches.

Each payment batch goes through an approval process. SAP BCM supports from 0 to 4 approval levels for each batch. Users approve batches from the workflow inbox SBWP or from an approval transaction BNK_APP. On the 1st approval level, users can approve or reject the whole batch or each individual payment. On the higher approval levels, only the whole batch can be approved or returned to a lower level.

Once the batch is approved, payment file is generated, and also the remittance advices. The generated file can now be transferred to the bank, for example via the SAP PI mechanism.

Batch monitoring transaction BNK_MONI allows users to check the current status of each batch throughout its life cycle. It also shows you the history of the status changes, the contents of the payment file, the approvers and so on.

Payment acknowledgements

Once the bank receives the payment file, it validates it and sends back notifications, also known as “acknowledgements” or ACKs. There can be up to 3 different levels of acknowledgements, but I practically had only seen two. For example, pain.002.001 (XML) file format specifies ACK1 as file structure validation and ACK2 as payment details’ validation.

Depending on your process, you can pick up ACK files manually or via PI. In either case, SAP standard transaction S_EBJ_98000208 can import the acknowledgement files. If you have different levels of ACK files, then you can have acceptance and rejection statuses on each of them. For example, your payment file may be accepted in general, but one payment in it may be rejected for some reason.

As with the payment batch approvals, users can monitor the status changes in BNK_MONI transaction.

Bank statement monitor

When bank accepts your payments, it will execute it. As a result, the company’s bank statement will show transactions.

You can receive statement in some different ways: enter manually, import a file, process the file via PI or even receive IDOCs. These are all standard, non-BCM specific processes.

It is easy to check the status of the bank statements manually if there is one, two or even half a dozen of bank accounts. But what if you have dozens? The Bank Statement Monitor comes to play!

Transaction FTE_BSM allows users to monitor that all necessary bank statements were received, processed and reconciled.

There is a separate article from SAP Expert that describes the functionality and configuration of Bank Statement Monitor in more details.

SAP BCM is a powerful tool that allows you to effectively process payments, monitor its statuses and have a proper audit trail of payment approvals.

Does your company use SAP BCM? Maybe you want it to be implemented? Then why not ask SAP Expert a question?

Our company collect customer payments through several banks.

Reading BCM, we understood it works great with Vendor payments and processing bank statement for conciliation but we have one concern about how to handle Customer payments using BCM.

Each bank send daily a file (not the bank statement) with the customer payments in a bank specific format (Bank Account, Our Customer ID, Payment Date, Invoice Number, Payment Number,Amount, Currency)

We were exploring if SAP BCM is able to process this files or if we need to do something outside BCM (As we are doing in ECC)

Your comments will be really appreciated.

Rob

Hello,

BCM is mostly targeted to approval and monitoring of outgoing payments. There is also a part called BSM, which can monitor incoming bank statements. But, as you said, your files are not statements, therefore it would be difficult to pair them with BSM even.

Great exposition, need more on PI or interfaces

Feel free to write an article about that, I’ll publish it as a guest post to compliment my own article.

Thanks for an informative and easy-to-understand blog!

Thank you! It is my pleasure!

Hi,

Great Article. SAP has also stand alone solution SAP FE PE. Do you know the difference and which Tool SAP has on its roadmap.

Thanks

Sorry, but I have never heard about SAP FE PE. Could you please provide more information as I was not able to find anything about that abbreviation. Thanks!